Venture Geopolitics Issue 18

21 October 2025

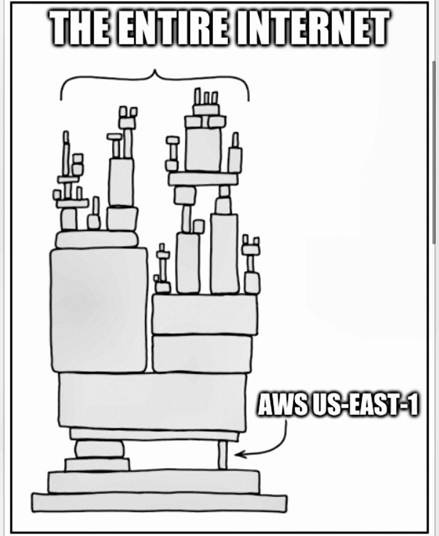

UK intelligence now counters four “nationally significant” cyberattacks every week; researchers found nearly half of all geostationary satellite transmissions remain unencrypted; and F5, a cybersecurity firm serving 80% of the Fortune 500, admitted it had been infiltrated by Chinese hackers since 2023. Add an Amazon data centre outage in Virginia that briefly knocked half the internet offline (including HMRC!), and the message is clear: the line between national security and commercial infrastructure is disappearing. Reliable, local infrastructure isn’t just about efficiency - it’s about sovereignty and security.

IPOs/Public

US govt shutdown still freezing the IPO market – just 6 small listings & 9 new SPAC filings last week (Seekingalpha)

Evernorth to list on Nasdaq via SPAC merger. Another “crypto treasury” play backed by Ripple – MicroStrategy model lives on! (Yahoo)

Major outage in AWS’ US-EAST-1 data centre disrupted services from Signal and Slack to HMRC and the London Stock Exchange. The fault exposed how centralised the digital world has become (Guardian)

Meta & Blue Owl set to strike $30B private-capital deal to build a hyperscale datacentre. Meta keeps 20%, offloading capex to private credit (Bloomberg)

Alibaba launched Aegaeon, new AI infrastructure tech supposedly cutting GPU use by 82% via dynamic pooling & token-level scaling (more here)

Big Dogs

OpenAI’s 5-year plan to grow from $13B ARR to $1T, implying >2x growth per year for 5 years (FT)

OpenAI made its first key hire for its “OpenAI for Science” initiative, a theoretical physicist, to apply models to deep scientific problems in maths & physics (here)

Sam Altman (OpenAI CEO) said verified users will be allowed adult content from Dec 2025 under a “treat adults like adults” policy – a shift toward user freedom, albeit raising concerns re. mental health, age-verification & liability (CNBC)

Anthropic is tailoring Claude for researchers & life-sciences firms. Novo Nordisk reportedly cut clinical documentation from 10 weeks to 10 mins, while Sanofi said most employees now use Claude daily (FT)

X will show more user-profile details (e.g. creation date, name-change history, app origin) to prove authenticity (Techcrunch)

Tempo (Stripe spinout building a layer-one blockchain for crypto payments) raised $500M (Greenoaks, Thrive) at $5B+ valuation (Silicon Republic)

Deel (global payroll / HR) closed $300M at $17.3B valuation (led by Ribbit Capital) (Techcrunch)

OpenEvidence (AI medical search & Q&A) raised $200M (Sequoia-backed) at $6B valuation – now handling 15M “clinical consultations” per month, up from 8.5M in July (NYTimes)

Dexory (warehouse robotics) raised $100M Series C to expand logistics automation (Sifted)

Venture Capital

Global VC topped $90B for the fourth straight quarter, fuelled by mega AI rounds (Anthropic, OpenAI). AI now accounts for over 50% of funding, while humanoid robotics led in deal count (CB Insights)

UK startups raised $9B in Q3, the second-highest on record, bringing YTD funding to $17.3B – on pace for $23.1B by year-end, matching 2024 (Dealroom)

$60B of the >$90B invested globally was in the US - and one third of US capital went to just 2 firms (Anthropic, xAI). Europe spread a similar amount across infra, deeptech, middleware & logistics, building the “backbone of the AI economy” rather than “chasing moonshots”. As private markets near a stress test, Europe’s diversified model potentially looks less speculative, more structurally resilient (according to EUVC)

Erebor (a neobank serving tech startups, crypto firms, AI, defence, manufacturing companies and related HNW individuals) - backed by Palmer Luckey and Peter Thiel - got approval from regulators (FT)

New funds focused on critical infrastructure & deeptech:

Ardian closed $20B for its fifth European infrastructure fund.

Kibo Ventures raised €73.5M for its fourth fund, backing pre-Series A & Series A deeptech startups.

Maia Ventures launched a €55M debut fund for agrifood tech, founded by David Bassani & Andrea Galassi.

Venture Geopolitics

The Agentic State whitepaper argues governments must adopt agentic AI to redesign public services. Early examples like Ukraine’s Diia.AI and Abu Dhabi’s TAMM 3.0 show how AI can already complete hundreds of end-to-end public tasks. Could AI finally close the usability gap between governments & the private sector?

The EU plans to impose new conditions on Chinese investment, including mandatory tech transfers to local firms. Brussels is weaponising economic policy across EVs & semiconductors. Dutch nationalisation of Nexperia underscores Europe’s determination to defend tech sovereignty (Bloomberg)

US & Australia agreed to invest $3B in critical-minerals projects to reduce reliance on Chinese supply chains. Meanwhile, Trump reiterated support for AUKUS, the US–UK–Australian defence alliance signed under Biden, reinforcing the bloc’s shared industrial & military agenda (Politico)

The collapse of a UK espionage trial has shaken confidence in the government’s China policy. The Crown Prosecution Service dropped the Cash–Berry case for lack of evidence, fuelling claims of political interference. Intelligence officials warn the decision weakens Britain’s stance on Beijing. A ruling on the controversial Chinese embassy in London has also been postponed (Guardian)

First Brands & Tricolor bankruptcies exposed $885M in losses for Jefferies & JP Morgan, spotlighting weak lending standards & opacity in the $2T private-credit market. The fallout highlights growing concern over systemic risk & the potential geopolitical ripple effects of US credit fragility (FT)

The upcoming Xi–Trump meeting underscores how China holds leverage. With a powerful grid, vast nuclear & coal output, and near-monopoly on rare earths, China sits at the heart of the AI supply chain. “China can leverage AI for automation & deliver cheaper, better products—redefining sectors like autos” notes Bobby Molavi (GS)

Europe’s consolidation challenge resurfaced as BBVA’s hostile bid for Banco Sabadell collapsed & Bouygues, Iliad and Orange abandoned telecom merger talks. Both episodes expose how national politics & regulatory caution continue to block scale, leaving Europe fragmented in a world dominated by US & Chinese giants (here and here)

Strategic Sectors

AI

Nebius (Netherlands-based GPU cloud upstart) could be Europe’s best shot at sovereign AI. As Kevin Xu notes, it uniquely controls the full hardware–software stack, partnering with Microsoft while building independent infrastructure (Interconnected)

A new study finds that reinforcement learning progress follows an S-curve, not an open-ended power law like model pre-training. The main bottleneck has shifted from compute power to methodology - how models are trained & adapted. AI progress now depends less on budgets & more on breakthroughs in approach. We’ve entered a phase driven by ingenuity, not just scale (here)

Joseph Briggs of Goldman Sachs argues the AI spending boom is economically rational & likely sustainable. Current capex - under 1% of US GDP - looks modest compared to past tech revolutions. GS estimates up to $8T in productivity-driven value creation, far outweighing today’s cost. The key question: who captures returns? Today’s giants gain from chip scarcity & vertical integration, but rapid innovation & low switching costs could favour fast followers.

China’s GenAI user base doubled to 515M in six months - now over a third of the population. Weekly use across major markets jumped from 18% to 34% YoY, showing behaviour is shifting from curiosity to habit (Azeem Azhar)

Derek Thompson’s “Why AI is not a bubble” (albeit largely concluding, it is) (here)

Bubble signs: sky-high valuations (e.g. Thinking Machines), unproven spending (e.g. Oracle’s $60B OpenAI contract), a 6-7x gap between AI data-centre capex (~$400B) & revenue (~$60B), opaque accounting, & tangled ownership webs (Anthropic–Amazon, Microsoft–OpenAI, Nvidia–AMD)

Counterpoints: Unlike the dot-com era, today’s giants have real users, profits, & growth - the “Magnificent Seven” plus Broadcom make up 37% of the S&P 500, with profits up 21% YoY. Generative AI revenue has grown 9x in two years. Microsoft’s AI business now exceeds $13B ARR (+175% YoY), Amazon reports triple-digit AI growth, & leading startups (OpenAI, Anthropic, Scale, Perplexity) are doubling or tripling revenue annually.

Conclusion: Thompson remains sceptical but concedes that if AGI emerges, comparisons to past bubbles collapse entirely - “Did you know that Pets.com delivers foods, drinks, and toys?” was a real line from an actual Pets.com ad; “Did you know that Pets.com will solve Alzheimer’s, invent nuclear fusion, and loosen the icy grip of inevitable cellular death?” was not, he quips.

Cybersecurity

UK’s NCSC handled 204 “nationally significant” cyberattacks in the 12 months to Aug 25 – up from 89 year prior i.e. ~4 major incidents a week (NCSC)

UC San Diego & University of Maryland researchers found around half of geostationary satellite communications are unencrypted – exposing consumer, corporate & military data to anyone with ~$800 in basic kit (Wired)

F5, which serves over 80% of Fortune 500 firms, was hacked by suspected Chinese spies who had lurked in systems since 2023. Comparisons to the SolarWinds being drawn – not a good look for a cybersecurity company! (Bloomberg)

Europol dismantled a major cybercrime-as-a-service network, arresting 7 suspects linked to large-scale fraud & hacking operations across Europe (here)

The World Economic Forum’s Cybercrime Atlas Report highlighted continued fragmentation in global defence efforts – progress, but too few joint operations to deter state-backed or industrial-scale actors (here)

Energy

Pensana scrapped its £250M rare-earth refinery in Hull - the UK’s flagship minerals project - after a £5M grant couldn’t match US subsidies. With 90% of refining still in China, and MP Materials winning $400M in US backing, the project’s collapse shows how state incentives now dictate where critical supply chains land (BBC)

Defence

Scott Bessent and US Army Secretary Daniel Driscoll have invited Apollo, Carlyle, KKR & Cerberus to pitch major projects for a $150B military infrastructure overhaul - another sign of deepening ties between private capital & US national security (FT)

Bessemer announced plans to invest up to $1B in European defence startups over the next few years. Military spending hit €343B in 2024 (+19% YoY) yet venture funding was just €5B - an enormous gap underscoring the decision (Sifted)

EVs

Stellantis partnered with Pony.ai to develop robotaxis for Europe - joining a wave of automaker–AI tie-ups (Lucid–Uber, Toyota–Waymo, Hyundai–Avride). A European carmaker choosing a Chinese partner, however, may stir political unease (here)

Waymo plans to launch driverless taxis in London by 2026, following Wayve’s ongoing Level 4 trials in the city’s dense traffic. Uber is both a commercial partner & investor in Wayve (The Observer)

Crypto

Paxos accidentally minted $300T worth of PayPal’s PYUSD stablecoin on Ethereum - a fat-finger error dwarfing its $2.4T circulating supply. The tokens were burned within 20 minutes, but the incident raised serious questions about safeguards in stablecoin issuance & collateral verification (Coindesk)

This article comes at the perfect time, honestly, because the increasing fragility of our digital backbone, especially with all these supply chain vulnerabilities and state-sponsored attacks, has been on my mind a lot latley. Your point about the blurred line between national securtiy and commercial infrastructure is spot on, and seeing how foundational everything from Signal to the LSE is to one AWS region really hammers home the urgency, especially as AI continues to entwine itself with every single layer of that stack.